The structure of the bsb account number does not permit for account numbers to be transferable between financial institutions. Branch manager branch operations manager retail banking manager retail district manager teller tasks teller tasks are performed in person at a retail branch location by teller line employees or bank tellers and includes basic banking transactions such as deposits check cashing withdrawals loan payments money orders and foreign currency.

Hsbc Bank Egypt Age African Growing Enterprises File

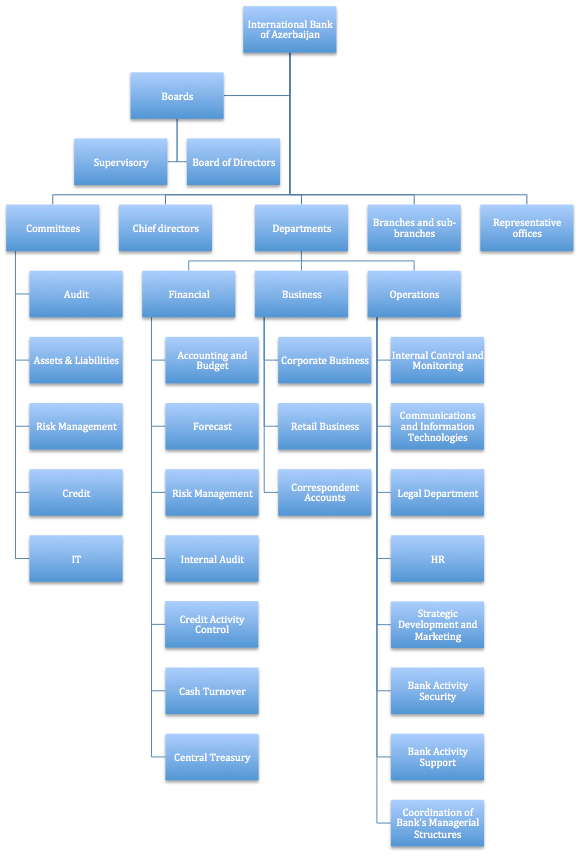

From the structure we can see how the functional relationship works in a branch.

Branch banking structure. Branch banking has undergone significant changes since the 1980s in. The organizational structure of a bank typically includes one top executive who is further supported by other senior members of the staff. Common retail branch management job titles.

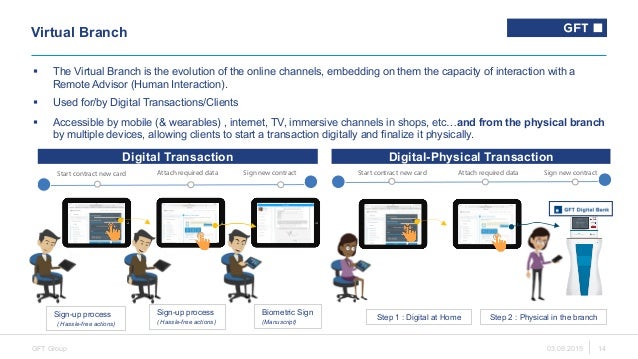

With changes in how banking is done as well as changes in how information is shared and stored it shouldnt be surprising that this has had effects on the organizational structure of banks today. The existing banking structure in india evolved over several decades has been serving the credit and banking services needs of the economy. Branch banking is the operation of storefront spinoffs offering the same key services as the institutions flagship home office.

Branch banking refers to a bank that is connected to one or more other banks in an area or outside of it. A unit bank is independent and does not have any connecting banks branches in other areas. He structure also explains the reporting.

The structure of the branch may be as under. A bank state branch often referred to as bsb is the name used in australia for a bank code which is a branch identifierthe bsb is normally used in association with the account number system used by each financial institution. In very large branches the structure will undergo slight changes as stated below.

Banks run through customer operating offices which are commonly know as bank branches. How a banks management is structured will affect the people who work there and customers alike. A single branch has a specific area of operation although not restricted to it.

The structure of banking in india played a major role in the mobilization of savings and promoting economic development. The branch is the focal point of all activities. This is the typical structure of a branch bank.

Branch banking structure 1. A branch banking center or financial center is a retail location where a bank credit union or other financial institution including a brokerage firm offers a wide array of face to face and automated services to its customers. Unit banking refers to a bank that is a single usually small bank that provides financial services to its local community.

In a retail bank the structure typically is separated by the various functions ranging from electronic banking services to customer service and managers of particular. There are multiple layers in todays banking structure. To its customers this bank provides all the usual financial.

New Organizational Structure Home Health Agency

Structure And Function Bdo Unibank Inc

File International Bank Azerbaijan Structure Jpg Wikipedia

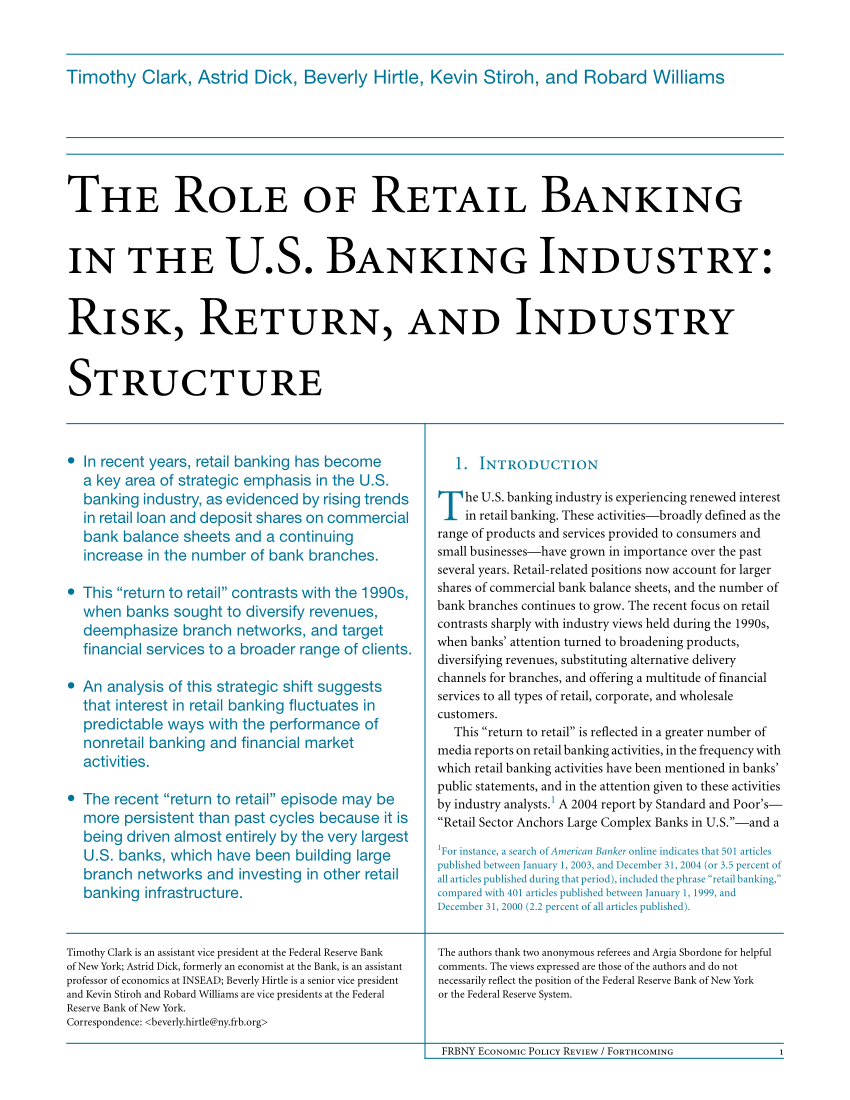

Pdf The Role Of Retail Banking In The U S Banking Industry Risk

Main Business Of Bank Of China

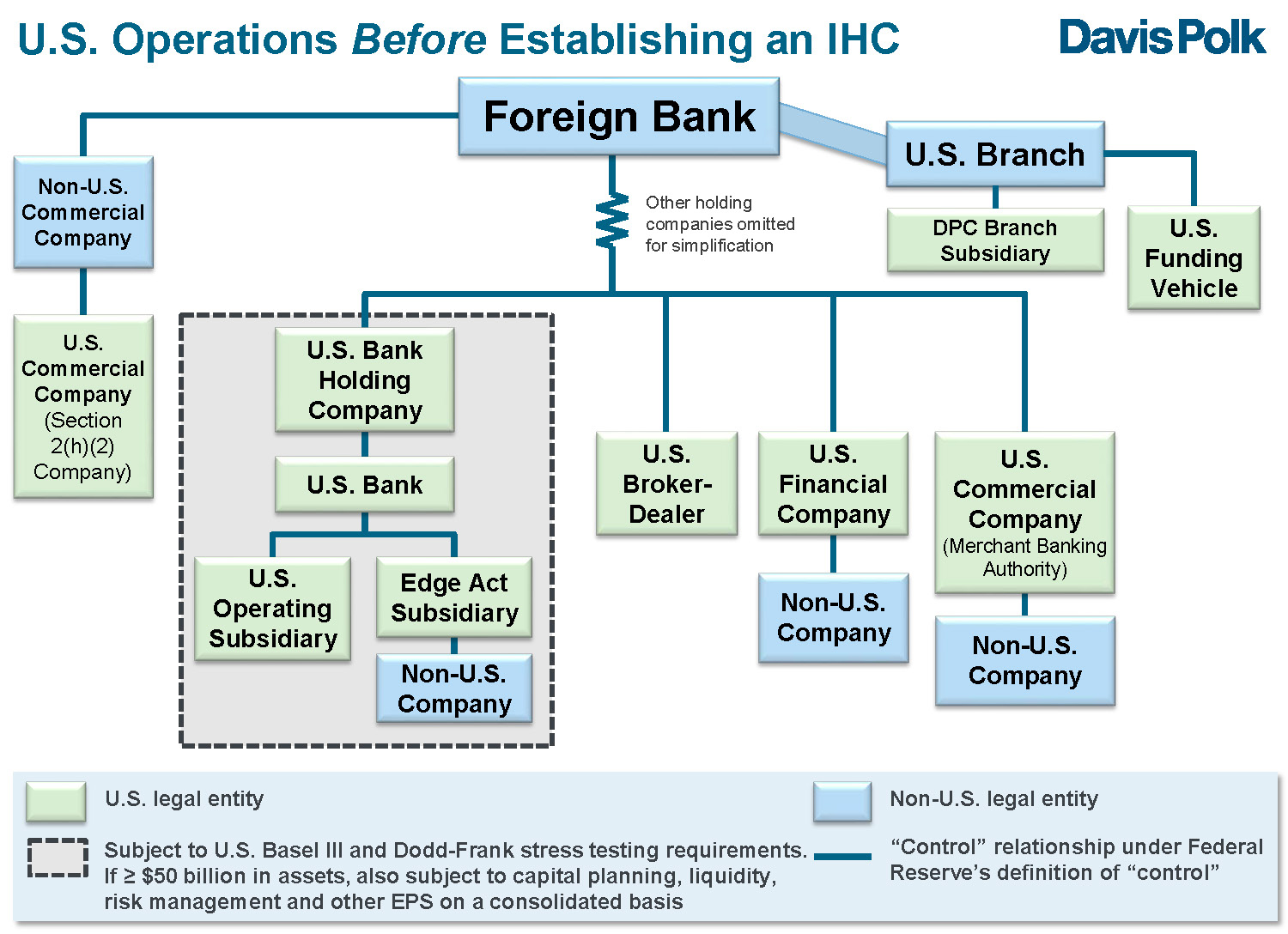

Us Intermediate Holding Company Structuring And Regulatory

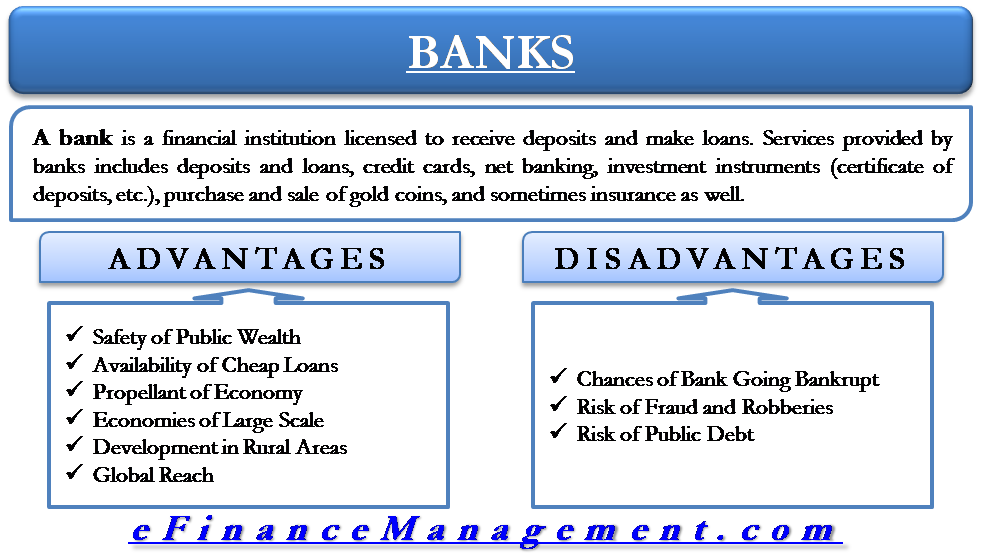

Advantages And Disadvantages Of Banks Efinancemanagement Com

Difference Between Unit Banking And Branch Banking With

The Organization Structure Of Banks Their Industry Ppt Video

74 Free Loan Letter In Company Pdf Download Docx

File Organogram Of Exim Bank Jpg Wikipedia

Different Types Of Banking System

Chapter Three The Organization And Structure Of Banking And The

Ppt Exporting Liquidity Branch Banking And Financial

Bangko Sentral Ng Pilipinas About The Bank Organization

Structure Of Banking Systems Unit Banking Branch Banking The

Branch Banking Vs Unit Banking Difference And Comparison Diffen

A Retail Banking Strategy For A New Age Mckinsey

A Retail Banking Strategy For A New Age Mckinsey